Greetings.

We’re on a roll now, so I thought we’d keep this commentary train moving. It can be tough to keep your momentum. I’ve noticed that sometimes thinking too much will destroy whatever momentum you’ve gathered. Evidence of too little thinking will be evident throughout this post and possibly all future posts.

Case in point: I was sorely tempted to answer the call of the Buffalo Bills and drive down to Highmark Stadium and shovel snow for $20/hour on Monday. Alas, Mrs. Treasury Guy (and Human Resources) convinced me that it was not advisable. Instead, I did the right thing and committed to my actual job. Here’s what happened:

Government Bond Yields

As we approach the end of day on Thursday, here’s where things stand:

| Term | Rate on Jan 18th | Rate 1 week ago | Rate 4 weeks ago |

|---|

| 2 years | 4.06% | 3.82% | 3.80% |

| 5 years | 3.54% | 3.31% | 3.23% |

| 10 years | 3.48% | 3.24% | 3.12% |

Yields are generally higher following the CPI data earlier this week. See details below.

Inflation

Annual inflation rose to 3.4% in December compared to 3.1% in November. The headline number was in line with expectations. Part of the year-over-year increase compared to November can be attributed to base effects related to a sharp decline in gasoline prices in December of last year which made for a tough comparison.

Unfortunately, the devil is in the details. The BoC’s preferred measures of core CPI were both higher than the headline number. CPI-trim rose two ticks to 3.7% while CPI-median was 3.6%. If you’d like to learn more about these and other measures of inflation, visit the BoC’s website.

(Note: Treasury Guy receives no referral fee from the BoC if you visit, but I’d encourage you to visit nonetheless)

The housing market continues to be an important contributor to the inflation story. Rents were +7.7% y/y and mortgage interest costs were +28.6% y/y. It’s tough to get inflation lower when everyone is paying more for the roof over their head. On the other side of the ledger, travel services are down 14.7% and home entertainment equipment is now 7.2%, strongly indicating a softening in discretionary spending and definitely fewer people buying CD-players and Dolby Surround Sound speakers. This is consistent with the message in the BoC business outlook survey released on Monday. Roughly two-thirds of consumers say they were reducing spending or planning to do so because of the expectations for interest rates and inflation.

The bottom line is that the headline number wasn’t shocking but there is sufficient stickiness to make the Bank’s job challenging. I wager that the Bank of Canada is likely to remain cautious.

Speaking of the Bank, remember…the BoC meets on Wednesday next week. As of Thursday evening, the probability of a 25bp cut is just 13%. The probability for the March 6th meeting is now at 15%, down from 35% 1 week ago.

Housing market activity

Unseasonably mild weather combined with falling mortgage rates contributed to an 8.7% increase in existing home sales in December compared to the prior month. Especially impressive considering that December is traditionally the slowest month of the year. Sales in December were also 9% higher than last year, but sales in 2023 as a whole were down 11% from 2022. In fact, existing home sales in 2023 reached their lowest level in 15 years. It’s so freeing even beautiful in a way, to have nowhere to go but up!

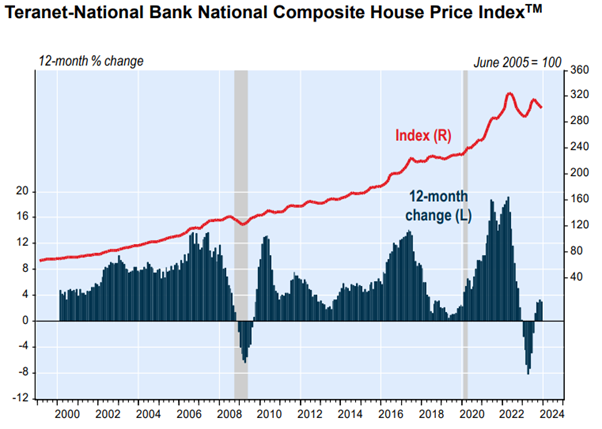

Despite the busier sales activity, the December Teranet-National Bank House Price Index was down 0.5% (seasonally adjusted) compared to November - lower for the third consecutive month. Affordability issues combined with a softer job market have contributed to the decline, despite population growth and persistent supply issues. The year over year change is UP 3.0%.

In the meantime, new listings dipped in December resulting in an improved sales to new listing ratio of 57.8 compared to 50.6. The activity also drove the inventory of unsold homes lower.

CMB operations update

You may recall that in the Fall Economic update (because I KNOW you all read it) the government announced its intention to purchase Canada Mortgage Bonds in 2024. New details reveal that the government, through the Bank of Canada as its fiscal agent, will purchase up to $30 billion of the maximum $60 billion of CMB issued in 2024.

These rates are criminal!

Non-Prime lenders - seriously non-prime lenders that is, are reacting to proposed changes to maximum interest rates. New federal restrictions would cap maximum interest charges at 35% compared to the current cap of 47%. The proposed change would not apply to ‘pay-day’ loan providers.

The intention, of course, is to make borrowing more accessible to the most economically vulnerable, but members of the Canadian Lenders Association contend that under the new cap, lending for the affected borrowers may be withdrawn entirely.

The Finance Department has been consulting on details related to the measures since the draft regulations were published on December 23rd.

In the meantime, Treasury Guy can assure you that no mortgage at First National is at risk of breaching the limit, old or new.

US Presidential Primary

Apparently, a candidate wearing orange makeup that didn’t participate in any of the debates leading up to the primaries handily won the Iowa caucuses on Monday. The candidate then reported to a Manhattan courtroom on Tuesday for the opening of a defamation trial. Pretty normal stuff, really.

Blue Monday

Monday was BLUE Monday…the third Monday in January. It has been determined to be the most depressing day of the year. Scientists did the research and boiled it down to an equation, so it must be true. According to the most recent data, 60% of the time, Blue Monday is the saddest day every time.

While the song has nothing to do with the day, a related listening assignment for our younger readers who are not immediately familiar with New Order, is to listen to Blue Monday (the biggest selling 12” single of all time) and tell me, “How does it feel when your heart grows cold”.

This week’s Top Tip

Sing in the shower.

Treasury Guy out.